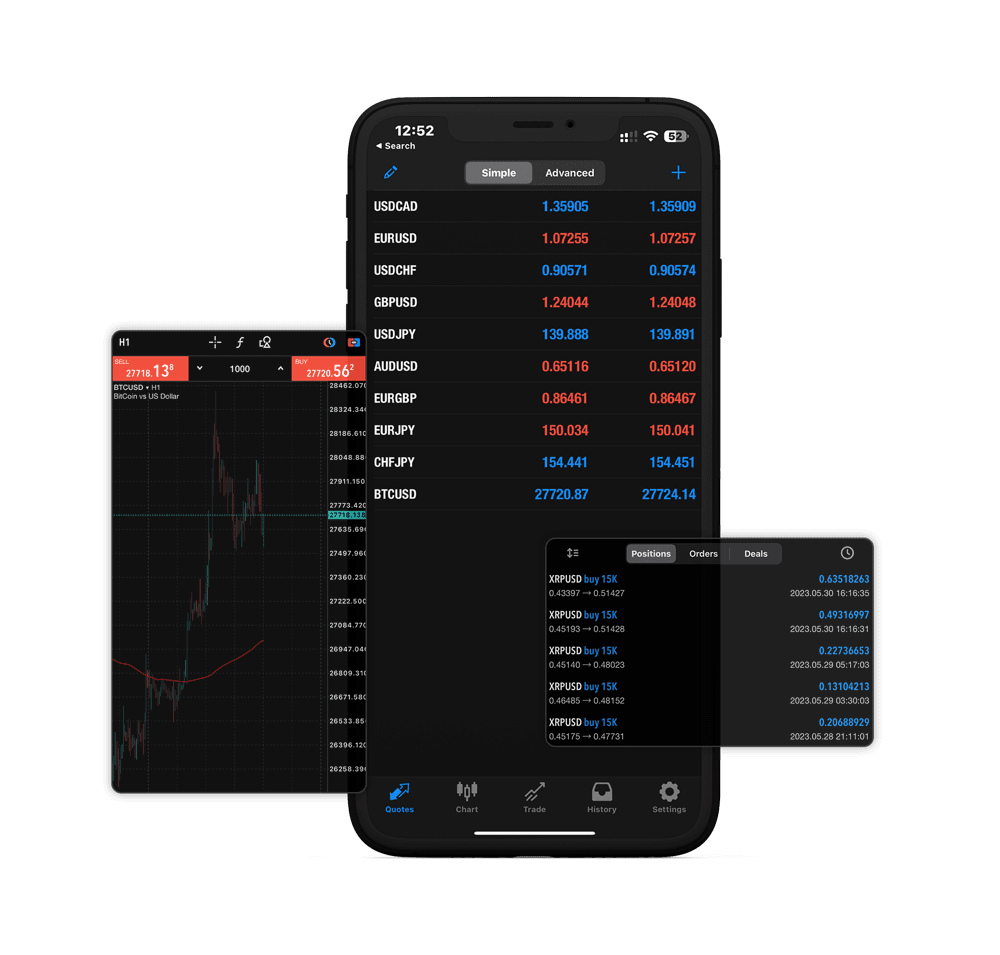

MAM – COPY Trading

Make trading simple with Copy Trading

Join a community of top global traders and take your investment strategy to the next level with our Exclusive Copy Trading Solutions. Follow the strategy of successful traders and automate your trading without having to constantly monitor the markets.

Risk Management

Leverage advanced risk control tools to manage exposure while mirroring trades.

Diverse Trader Options

Access a wide array of expert traders and strategies for maximum diversification.

Tailored Control

Retain full control over copied trades, with the flexibility to adjust or halt replication as needed.

Discover the Exclusive Advantages

Experience unparalleled copy trading benefits with Phoenix FX and elevate your trading journey.

Diverse Trader

Options

Access a wide array of expert traders and strategies for maximum diversification.

Read MoreRisk Management Solutions

Leverage advanced risk control tools to manage exposure while mirroring trades.

Read MoreAdvanced Performance Monitoring

Monitor and analyze the performance of copied trades for well-informed decision-making.

Read More

Tailored

Control

Retain full control over copied trades, with the flexibility to adjust or halt replication as needed.

Read More

Personalized

Allocation

Tailor fund allocation to match your risk tolerance ensuring a customized approach to copied trades.

Read More

Benefits

of

MAM Accounts:

- Efficiency: MAM accounts streamline the trading process by allowing money managers to execute trades across multiple accounts simultaneously, eliminating the need for manual intervention.

- Customization: Investors can customize their risk preferences and account settings, providing flexibility in managing their investment portfolio within the MAM structure.

- Scalability: MAM accounts are scalable, accommodating both individual investors and larger institutional clients seeking to allocate funds across multiple trading accounts.

- Control: Investors retain full control over their accounts, with the ability to monitor trades, adjust settings, and withdraw funds at any time.

Frequently Asked Questions

What is a MAM account?

A MAM account, which stands for Multi-Account Manager account, is a trading structure where a money manager executes trades on behalf of multiple individual accounts simultaneously. This setup allows for efficient trade execution across all accounts under management.

How does a MAM account work?

In a MAM account structure, the money manager allocates trades across multiple accounts based on predefined parameters such as lot size or percentage allocation. This ensures that all accounts receive the same trading signals at the same time, streamlining the trading process.

How can I start with a MAM account?

To start with a MAM account, you typically need to open an account with a brokerage or investment firm that offers MAM services. Once your account is set up, you can allocate funds to the MAM account and begin trading with the assistance of a money manager.

Is there a minimum investment required for a MAM account?

While investors do not directly execute trades in a PAMM account, they have full control over which money manager or trader they choose to invest with. Additionally, investors can monitor the performance of their PAMM account in real-time.

Is there a minimum investment required for PAMM accounts?

The minimum investment requirement for a MAM account can vary depending on the brokerage or investment firm offering the service. It's advisable to check with the specific provider for their minimum investment threshold.

How can I monitor the performance of my MAM account?

Most brokerage or investment firms provide online platforms or tools where investors can monitor the performance of their MAM accounts in real-time. These platforms typically display account balances, open positions, trading history, and other relevant information.

Can I withdraw funds from my MAM account at any time?

Yes, investors retain full control over their MAM accounts and can withdraw funds at any time. However, it's important to note that certain withdrawal policies or restrictions may apply, so it's advisable to review the terms and conditions provided by your brokerage or investment firm.

Are there any fees associated with MAM accounts?

Yes, there are usually fees associated with MAM accounts, including management fees and performance fees charged by the money manager or the brokerage firm. These fees vary depending on the provider and the terms of the agreement, so it's important to understand and consider them before opening a MAM account.

Is MAM trading suitable for all investors?

MAM trading may not be suitable for all investors, as it involves a certain level of risk and requires an understanding of the financial markets. It's important for investors to assess their risk tolerance and investment goals before participating in MAM trading and to consult with a financial advisor if necessary.